While it’s true that the southern regions of England typically boast higher earnings compared to the rest of the country, this financial advantage comes with its own set of challenges, particularly when it comes to the rental market. For those seeking to rent a home in the south, a larger slice of their income will be dedicated solely to meeting rental expenses.

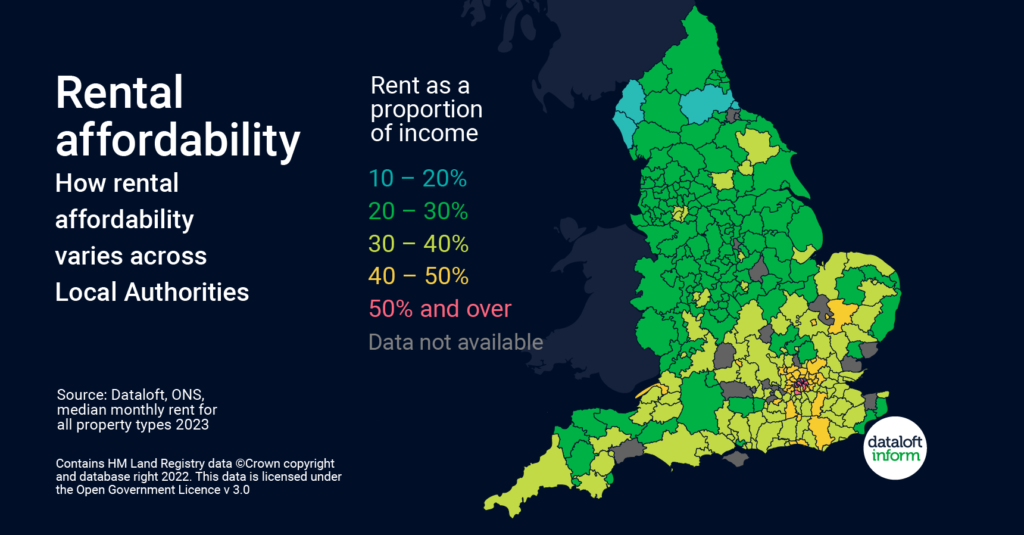

The concept of ‘Rental Affordability’ serves as a valuable metric to gauge the strain exerted on a local rental market. This is determined by calculating the average rent in relation to the average earnings within a specific geographical zone, such as Local Authorities. Essentially, it’s a ratio that highlights how much of a person’s earnings would need to be set aside just to keep a roof over their head.

Nowhere is this issue more pronounced than in the capital city of London. A typical Londoner, earning an average salary within the city, would find themselves allocating a staggering 40% or more of their income just to cover rent. This contrasts sharply with much of the remaining UK, where the proportion of income spent on rent usually falls within a more manageable range of 20% to 30%.

However, it’s not all doom and gloom. One silver lining is that while rents have been on the uptick, so have salaries. For those who are earning more, this can sometimes mean that there’s still a reasonable amount left over for other life expenses, from groceries to leisure activities.

Interestingly, there are pockets within the home counties that defy the general trend, offering a more balanced scenario. In areas like East and North Hertfordshire, Dover, and Folkestone, only about 20–30% of a typical income goes toward rent, making these locations outliers in an otherwise challenging landscape.

Source: #Dataloft Rental Market Analytics, Information Works, Land Registry.