Mortgage borrowers who have locked in fixed rates can breathe a sigh of relief, having sidestepped the brunt of the interest rate hikes. Currently, the trajectory for interest rates is on a decline, offering a glimmer of hope for those concerned about escalating borrowing costs. However, a turning point looms for approximately 1.5 million homeowners as we move into 2024. These individuals are on the cusp of concluding their fixed-rate mortgage agreements, and the landscape they’re about to navigate presents a stark contrast between the interest rates for new and existing loans.

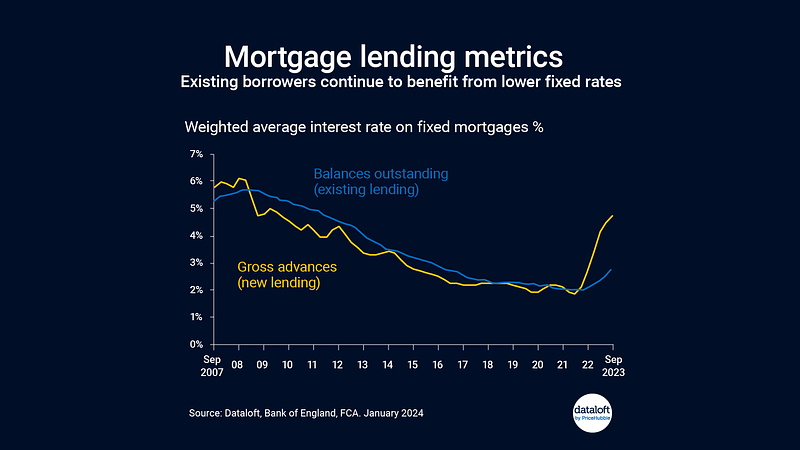

Recent data paints a vivid picture of this disparity: the average fixed rate for new mortgages stood at 4.73%, significantly higher than the 2.76% average rate enjoyed by existing borrowers (statistics valid until the end of the third quarter). This indicates that those transitioning from their fixed-rate deals are likely to encounter a noticeable increase in their monthly mortgage payments. Despite this, there’s a silver lining. The current trend in swap rates and mortgage rates suggests a downward movement, hinting at potentially more favourable conditions for borrowers seeking new deals.

It’s imperative for homeowners approaching the end of their fixed-rate terms to actively explore the market. While the gap between the interest rates on new loans (gross advances) and those on existing loans (balances outstanding) might seem daunting, the evolving financial landscape could work in their favour. With rates expected to continue their descent, unless there’s an unexpected and dramatic shift, the opportunity to secure a deal that mitigates the impact on monthly outgoings is within reach.

This situation underscores the importance of vigilance and proactivity for mortgage holders. The transition from a fixed-rate deal could indeed result in higher costs, but the current downward trend in interest rates offers a beacon of hope. By thoroughly researching and comparing the available mortgage options, borrowers can position themselves to take advantage of potentially lower rates, easing the transition and ensuring financial stability.

As we navigate through these changing tides, it’s crucial to stay informed and prepared. The end of a fixed-rate mortgage term doesn’t necessarily spell financial strain, provided homeowners take the initiative to seek out the best possible deals. With interest rates on a downward trajectory, the market may present opportunities for savings that could offset the increased costs associated with new mortgage rates.

In conclusion, while the journey ahead for those transitioning from fixed-rate mortgages may seem daunting, the current financial climate offers a ray of hope. By keeping abreast of market trends and actively seeking out the most competitive rates, homeowners can navigate this transition more smoothly, ensuring that their dream of affordable homeownership remains well within reach.

This proactive approach, coupled with the favourable direction in which mortgage rates are heading, could make all the difference in managing monthly mortgage payments effectively.