In their latest assembly this November, the Bank of England maintained the benchmark bank rate at a steady 5.25%. The implications of this decision are significant for the residential property sphere, as mortgage affordability—a direct offshoot of interest rates—stands as a pivotal factor shaping the real estate market’s trajectory.

A collection of expert predictions gathered by HM Treasury indicates a common belief that interest rates have reached their zenith. The terminal projection for the bank rate at the close of 2023 hovers at around 5.3%, with anticipations set for a downturn to 4.7% as we approach the final quarter of 2024.

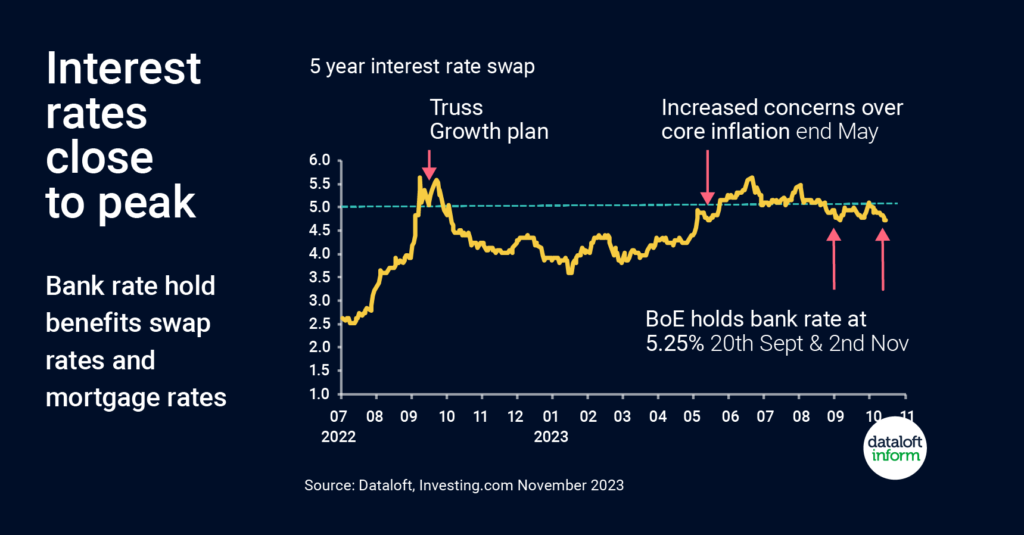

Delving into the nuances of mortgage expenses, swap rates—especially the 5-year swap rates—are particularly telling. These rates essentially mirror the borrowing costs lenders incur and have shown a favorable response to the Bank of England’s recent rate decision, dipping to their most modest figures since the month of May.

Despite the market still acclimatizing to the escalated interest rates, with mortgage approvals observing a downtrend, there’s an emergent optimism. As rates plateau or begin their descent, we can expect a rejuvenation in market confidence, likely materializing by Spring 2024. For those keeping a keen eye on these financial barometers, sources like #Dataloft and Investing.com are valuable touchpoints for up-to-the-minute insights, with the HM Treasury Forecasts, current as of October 2023, providing foundational data.