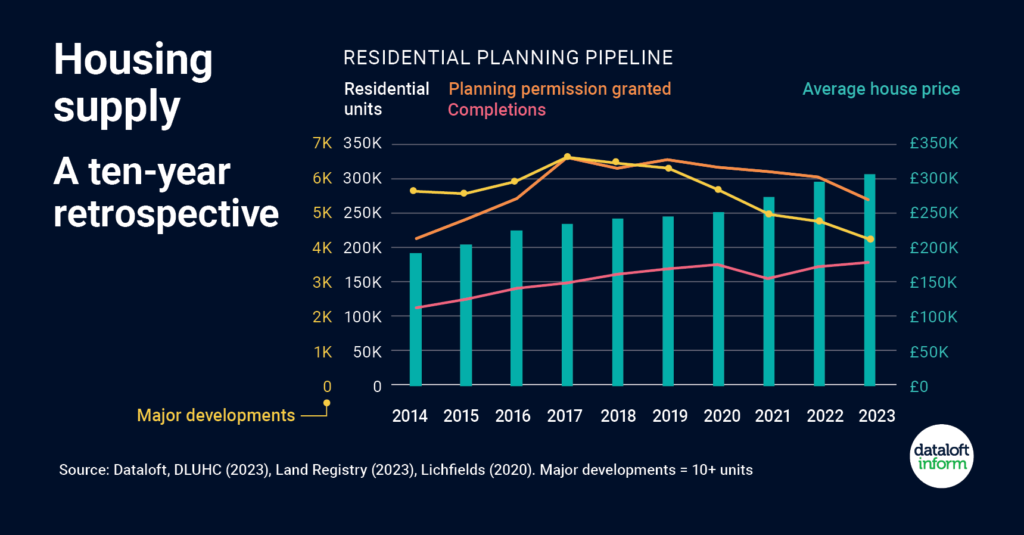

Recent statistics on planning applications reveal a notable and sustained decline in the approval of major residential projects throughout the entire country. This decline has been evident since its peak at an impressive 6,617 approvals back in 2017. As of now, we find ourselves at a considerably reduced figure of 4,221 major residential approvals, marking the lowest point in the span of 10 years.

However, amidst this decline, there is a silver lining to be acknowledged. The number of newly constructed homes has reached a remarkable high, reaching levels unseen in a decade. Over the course of the past 12 months alone, a staggering total of more than 177,000 homes have been completed, indicating that we are still reaping the benefits of the peak in residential approvals experienced between 2017 and 2019.

Interestingly, research conducted by Lichfields in 2020 sheds light on the timeframes involved in the development process. It was found that projects consisting of over 500 homes typically require an average of 3 years from initiation to completion, while larger schemes involving 200 or more homes can take as long as 8.4 years. Therefore, it becomes evident that the positive impact of the peak witnessed between 2017 and 2019 will continue to shape the immediate future of residential development.

Furthermore, it is worth noting that despite the fluctuations in the residential planning pipeline, average house prices have steadily risen over the course of the past decade. This rise seems to remain unaffected by the current state of the planning landscape. These insights are derived from reliable sources such as Dataloft, DLUHC (2023), Land Registry (2023), and Lichfields (2020), providing a comprehensive understanding of the prevailing conditions in the housing market.