The Chelmsford Property Market is a very interesting animal and has been particularly fascinating over the last 12 years when we consider what has happened to Chelmsford rents and house prices.

There’s currently much talk of what will happen to the rental property market following Brexit. To judge that, I believe we must look what happened in the 2008/9 credit crunch (and what has happened since) to judge rationale and methodically, the possible ramifications for long-term investors in the Chelmsford property market. You see, an important, yet overlooked measure is the performance of rental income vs house prices (i.e. the resultant yields over time). In Chelmsford (as for the rest of Great Britain), notwithstanding a slight drop in 2008 and 2009, property rentals have been gradually increasing.

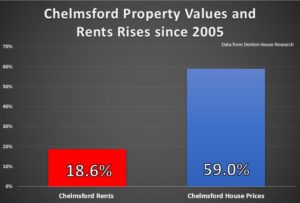

The income from rentals has been progressively increasing over the last 12 years. Today, they are 18.6% higher than they were at the beginning of 2005. In fact, over the last five years, the average growth has been 1.9% per annum. From a landlord’s point of view, increase in average rental income is not to be sneered at. However, the observant readers will be noting that we are ignoring an important factor – our friend inflation.

Turn the clock back to 2005, and we have a property being rented for say £900 a month and that is still being rented at £900 a month today, in Spring of 2017. While the landlord is not getting any less income, this £900 is no longer worth as much. Let me explain, in 2005, £900 may have bought a two-week 4* holiday in Italy. Yet, holidays have increased in line with inflation (which has been 38.5% since 2005), so our holiday would cost today £1,246 (£900 + 38.5% inflation = £1,246). Therefore, the landlord could no longer afford the same holiday, even though having the same amount in pound notes from their rental property.

This means when we compare rents in Chelmsford to inflation since 2005, Chelmsford landlords are worse off today, when they receive their monthly rental income, than they were in 2005 by 19.9% in real terms (rents increased by 18.6% since 2005, less the 38.5% inflation since 2005 – net affect 19.9% drop)

However, rental income is not the only way to generate money from property as property values can increase. Although in the short term, cash flows are diminishing, many Chelmsford landlords may be content to accept that for a colossal increase in capital value.

Property values in Chelmsford have risen by 59.04% since 2005

This equates to a reasonably salubrious 4.92% per annum increase over the last 12 years. Even more interesting that this includes the 2008/9 property crash, this will make those Chelmsford landlords and investors feel a little better about the information regarding rents after inflation.

Moving forward, the prospects of making easy money on buy to let in Chelmsford have diminished, when compared to 2005. Last decade, making money from buy to let was as easy as falling off a log – but not anymore.

It would be true to say, my rental income verses property prices study does lead to noteworthy thoughts. I am often asked to look at my landlord’s rental portfolios, to ascertain the spread of their investment across their multiple properties. It’s all about judging whether what you have will meet your needs of the investment in the future. It’s the balance of capital growth and yield whilst diversifying this risk.

If you are investing in the Chelmsford property market, do your homework and do it well. While some yields may look attractive, there are properties in many areas that do not have the solid rudiments in place to sustain them. If you are looking for capital growth, you might be surprised where the hidden gems really are. Take advice, even ask your agent for a portfolio analysis like I offer my landlords. The clear majority of agents in Chelmsford will be able to give a detailed analysis of past and anticipated investment opportunity (especially the awful effect of inflation) on your portfolio. However, if they can’t help – well, you know where I am, the kettle is on!

For more thoughts on the Chelmsford Property market – visit the Chelmsford Property Blog www.chelmsfordpropertyblog.co.uk