What is it to be British? Our stubbornness, long-suffering stoicism, our vexation at injustice, our obsession with football and rugby, we are weather obsessed external awkward noncommittal modest people whilst underneath seething like a volcano because someone jumped the queue….. and our No.1 obsession is with the property ladder.

This ‘love affair’ with owning our own home has been both good and bad for the UK as a whole; giving people financial freedom in their later years whilst also reducing the quantity (and quality) of housing provision whilst adding the extra pressure of a ‘them and us’ society. Strong words I know .. but let me explain more.

I honestly believe that most Governments since the end of the 1970’s, Conservative and Labour, have attempted to nourish our addiction to home ownership (to keep the housing market on track) with the Council House Right to Buy sell off in the 1980’s, tax relief of mortgages, relaxation of the mortgage rules in the late 1990’s/early 2000’s and most recently, the Help to Buy scheme.

But the Brits haven’t always had this obsession.

Roll the clock back 100 years and, in 1918, just under a quarter of all Brits owned their own homes and the other 77% rented. Go back 50 years to 1968, and only 46% of people owned their own home, the rest rented. This homeownership thing is quite a recent phenomenon.

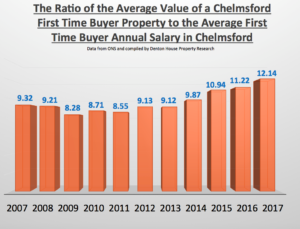

According to my research, anyone looking to get a foot onto the property ladder as a first-time buyer in Chelmsford today, AS A SINGLE PERSON, would need to spend 12.1 times their earnings on a Chelmsford first time buyer property.

Using the numbers from the Office of National Statistics (ONS), the average value of a first-time buyer property in Chelmsford today is £247,000, compared to £173,000 in 2007. If we divide those property values by the average annual earnings of first time buyers – in 2007, that was £18,562 pa and that has risen to £20,340 pa .. giving us the ratio of 12.1 to 1.

However, what must be remembered is that these are raw statistics from the ONS and don’t take into account other factors, like most people buy their first home as a couple. Also, mortgage rates are at an all-time low and who can remember mortgage rates of 15%+ in the 1990’s, meaning borrowing today is relatively cheap. Also, 95% Loan to Value first time buyer mortgages have been available since the end of 2009 (i.e. you only need to save a 5% deposit) and first time buyer rates of 2.19% fixed for 5 years can be obtained (correct at time of writing this article)… it is cheaper to buy than rent .. fact!

I believe there has been a mind-set change to owning a home. Home ownership was the goal of the youngsters in the latter half of the 20th century. Britain is changing to a more European model of homeownership, where people rent in early to mid-life, wait to inherit the money from their parents when in their 50’s and then buy.. thus continuing the circle – albeit in a different way to the last Century.

This means the demand for privately rented accommodation will, in the long term, only continue to grow. If you would like to know more about where the hot spots are for that growth in Chelmsford, then one place would be my property blog www.chelmsfordpropertyblog.co.uk or if you want to drop me an email or telephone call, feel free to pick my brain on the best places to buy (and not to buy) in Chelmsford to ensure your rental investment gets you want you want. The choice is yours!